Cryptocurrency trading

Deze naam is een pseudoniem dat gemaakt werd voordat hij lid werd van de ShibArmy (mensen die in Shiba Inu investeren). Hij geeft net als Ryoshi aan dat zijn eigen persoon er niet toe doet. Defective pixels. How to check Zijn ideeën komen overeen met die van Ryoshi op het gebied van een leiderloze community die volledig gedecentraliseerd is, zoals beschreven in de Woofpaper, een soort whitepaper waar de geschiedenis in staat van $SHIB.

Met meer dan 14.000 reviews op TrustPilot (gemiddelde score van 9.0) en een officiële registratie bij De Nederlandsche Bank (DNB), is Anycoin Direct sinds 2013 een van de meest vertrouwde crypto diensten in Europa

DISCLAIMER Cryptocurrencies, inclusief Shiba Inu Token, zijn speculatief, complex en brengen aanzienlijke risc’s met zich mee – ze zijn zeer volatiel. Prestaties zijn onvoorspelbaar en prestaties uit het verleden van SHIB zijn geen garantie voor toekomstige prestaties. Overweeg uw eigen omstandigheden en win extern advies in voordat u overgaat tot aankoop. U dient ook de aard van een product of dienst te verifiëren (inclusief de juridische status en relevante regelgeving) en de relevante websites van regelgevende instanties te raadplegen voordat u een beslissing neemt.

SHIB is not intended to be a currency but rather a community token that can be used to interact with the Shiba Inu ecosystem. The ecosystem includes a decentralized exchange called ShibaSwap, a non-fungible token (NFT) marketplace, and a metaverse called Shibarium.

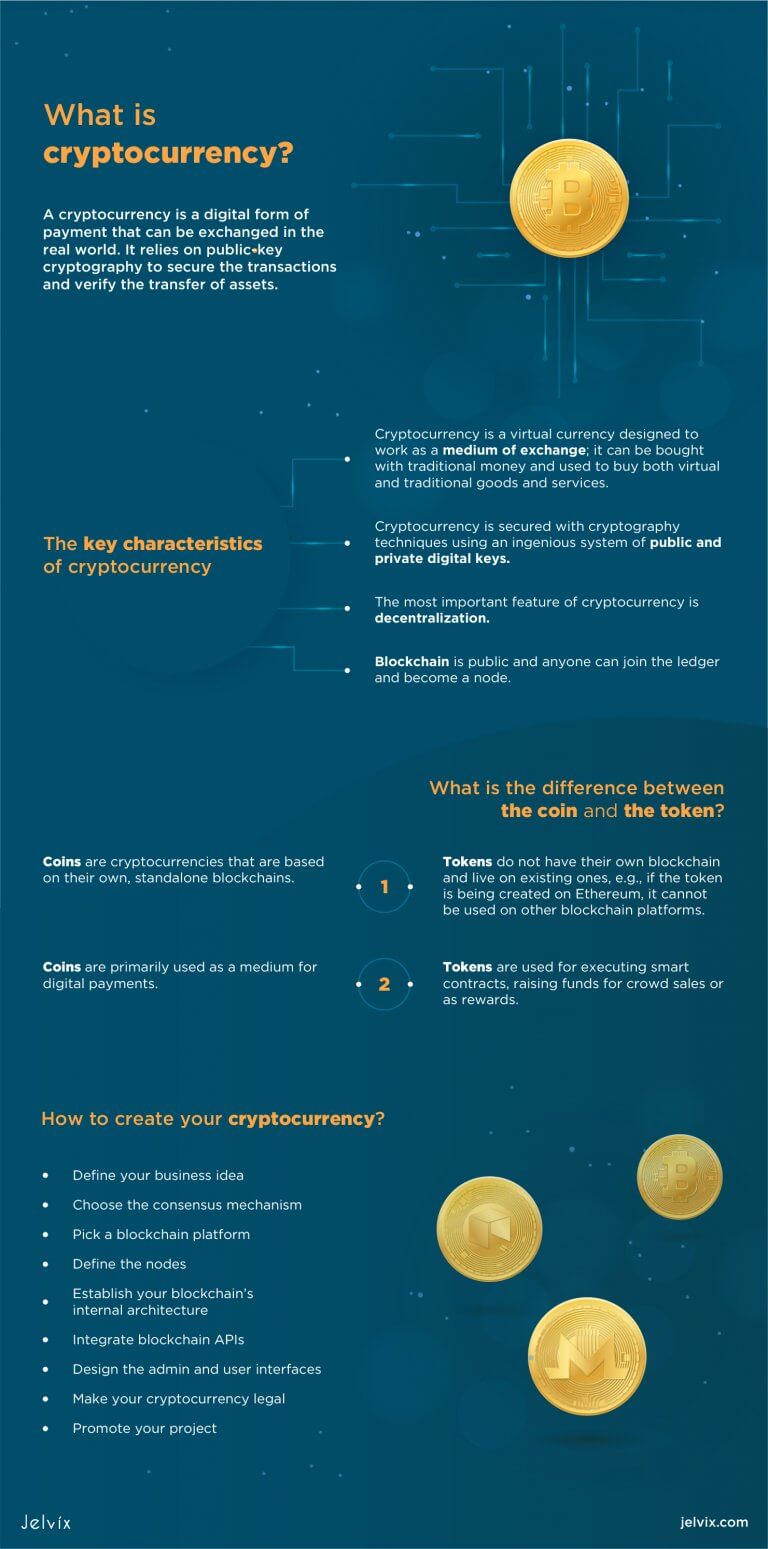

How to make a cryptocurrency

Units of cryptocurrency are created through a process called mining, which involves using computer power to solve complicated mathematical problems that generate coins. Users can also buy the currencies from brokers, then store and spend them using cryptographic wallets.

There are several advantages of using an existing blockchain platform to create a new cryptocurrency, such as stronger security, community, cost savings, and seamless integrations with related applications. However, there are also some disadvantages, including limited customization options, greater competition, reliance on the platform’s infrastructure and development team, and governance that can affect your decision-making abilities.

Creating your own blockchain is the most complicated method and requires you to have the advanced technical knowledge to write your own code but it also offers you the most flexibility to create an innovative cryptocurrency.

Units of cryptocurrency are created through a process called mining, which involves using computer power to solve complicated mathematical problems that generate coins. Users can also buy the currencies from brokers, then store and spend them using cryptographic wallets.

There are several advantages of using an existing blockchain platform to create a new cryptocurrency, such as stronger security, community, cost savings, and seamless integrations with related applications. However, there are also some disadvantages, including limited customization options, greater competition, reliance on the platform’s infrastructure and development team, and governance that can affect your decision-making abilities.

Creating your own blockchain is the most complicated method and requires you to have the advanced technical knowledge to write your own code but it also offers you the most flexibility to create an innovative cryptocurrency.

Cryptocurrency market cap

According to the European Central Bank, the decentralization of money offered by bitcoin has its theoretical roots in the Austrian school of economics, especially with Friedrich von Hayek in his book Denationalisation of Money: The Argument Refined, in which Hayek advocates a complete free market in the production, distribution and management of money to end the monopoly of central banks.

CoinMarketCap does not offer financial or investment advice about which cryptocurrency, token or asset does or does not make a good investment, nor do we offer advice about the timing of purchases or sales. We are strictly a data company. Please remember that the prices, yields and values of financial assets change. This means that any capital you may invest is at risk. We recommend seeking the advice of a professional investment advisor for guidance related to your personal circumstances.

Play-to-earn (P2E) games, also known as GameFi, has emerged as an extremely popular category in the crypto space. It combines non-fungible tokens (NFT), in-game crypto tokens, decentralized finance (DeFi) elements and sometimes even metaverse applications. Players have an opportunity to generate revenue by giving their time (and sometimes capital) and playing these games.

Buy cryptocurrency

This site is designed for U.S. residents. Non-U.S. residents are subject to country-specific restrictions. Learn more about our services for non-U.S. residents, Charles Schwab Hong Kong clients, Charles Schwab U.K. clients.

Many people worldwide have contracted the cryptocurrency bug. Everybody wants to get in on the fun. So how exactly do you purchase Bitcoin anyway? It’s easier than you think, and there are many avenues you can explore:

It might have been complicated to buy Bitcoin in its early years. However, as it has become more prevalent throughout the global economy, the crypto industry has evolved and improved in recent years; today Bitcoin is easily accessible, even if you’re a beginner!

Throughout its ten years of operation, CEX.IO has set itself apart by offering Bitcoin traders and cryptocurrency enthusiasts access to high-quality markets with appropriate liquidity levels. We believe that an intuitive, user-friendly interface combined with advanced trading instruments, and backed by world-class security is the perfect tool for navigating the crypto ecosystem.

Cryptocurrency is a virtual currency secured through one-way cryptography. It appears on a distributed ledger called a blockchain that’s transparent and shared among all users in a permanent and verifiable way that’s nearly impossible to fake or hack into. The original intent of cryptocurrency was to allow online payments to be made directly from one party to another without the need for a central third-party intermediary like a bank. However, with the introduction of smart contracts, non-fungible tokens, stablecoins, and other innovations, additional uses and capabilities for cryptocurrency are rapidly evolving. Cryptocurrencies are not FDIC insured and are not protected by SIPC or CFTC regulations.